“Winning by not losing.”

Sounds counterintuitive, right? Take football for example… In football, there are two ways to win a game. Okay, not true, there are numerous ways… but hang with me. One way is to score more points than the other team. Pretty obvious. Teams that take this approach invest in star Quarterbacks and surround them with great talent to score as many points as possible. The other approach to winning games is by not letting the other team score… aka eliminating your scoring deficit as much as possible. Teams that take this approach invest significantly in their defensive line-up and strategy. These teams are focused on forcing turnovers, having a low 3rd down conversion rate, and sometimes, if they are lucky, force turnovers that lead to touchdowns. These teams rarely get into shoot-outs, you know, like the Pac-12 and Big-12. These defensive-minded teams get in all-out brawls. Games that end in a 13-10 slugfest. – Can you tell we are ready for football season?

Investing can work the same way. Having an asset allocation that positions you in a slightly more defensive posture can help reduce downside risk. If, with the right blend of assets, you successfully trim off your downside exposure, then you actually do not have to gain as much on the upside to achieve new highs. – In other words, if you have a great defense, your offense does not necessarily have to work as hard to have great returns. – This is simple math.

If your portfolio is down 50%, it does not take a 50% return to get you back to ‘even’ or where you started. No, it takes much more… You actually need to achieve a 100% return to get back to even!

Sometimes the best offense is great defense.

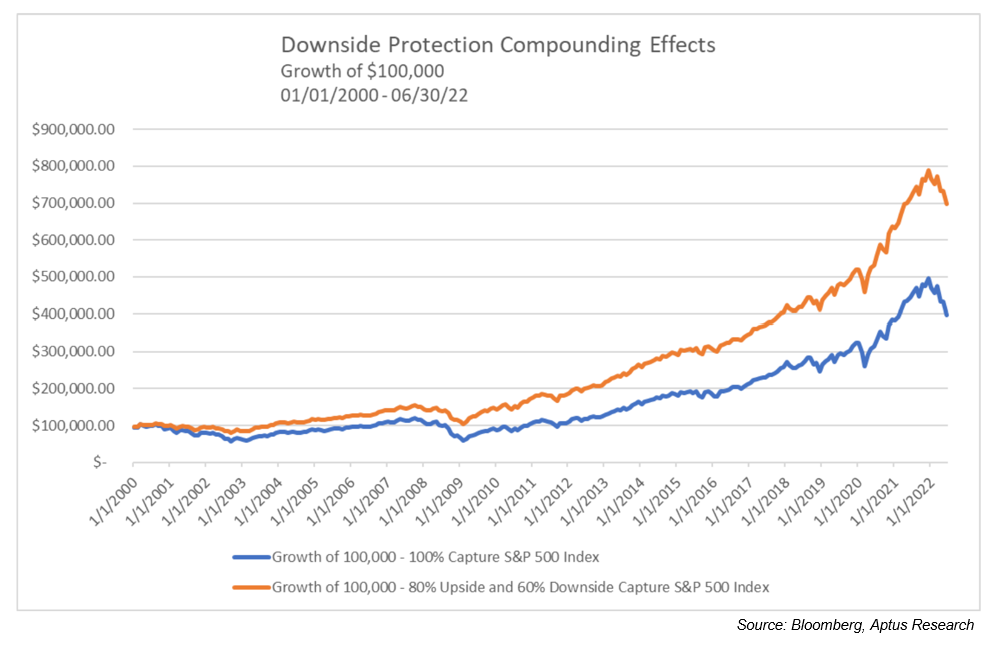

The graph below shows a portfolio with an 80% Upside Capture and 60% Downside Capture S&P 500 Index versus the 100% Capture S&P 500 Index. This is a hypothetical scenario showing the value if you were to invest $100,000 in each strategy at the beginning of January 2000. Of course, starting in the ‘Tech Bubble’ of the early 2000s allows the risk-adjusted strategy to outperform the index quite early. By the next crises, the ‘Global Financial Crisis’ of 2008, the two investment performances begin to separate even more and there becomes a massive outperformance from the portfolio with the 60% Downside Capture and 80% Upside Capture. If you track the performance through 2020 you can see that the separation really jumps off the page!

At Sugarloaf, we believe this is the most efficient way to compound capital and works for both accumulators and those who’ve retired and are taking withdrawals. If your portfolio limits your downside exposure – you know, plays great defense – then the math shows that you don’t have to throw Hail Mary’s to win games. You can actually afford for your offense to not put up 48 points every game just to win. To take it further, more risk could actually result in an interception, a fumble, a poor play call, or just downright being too aggressive. All of which are no good for you.

We want you to stay in the game… In fact, we believe it’s essential that you stay in the game. But taking the right amount of risk and limiting your downside exposure can help you stick to your financial plan and achieve your future goals despite what the market gives you. So, let’s win by playing good defense. There will be a time and opportunity for the offense to shine soon enough.

You know how the old saying goes… “Offense wins games. Defense wins championships.”

– Preston Henry CFP®, CIMA®