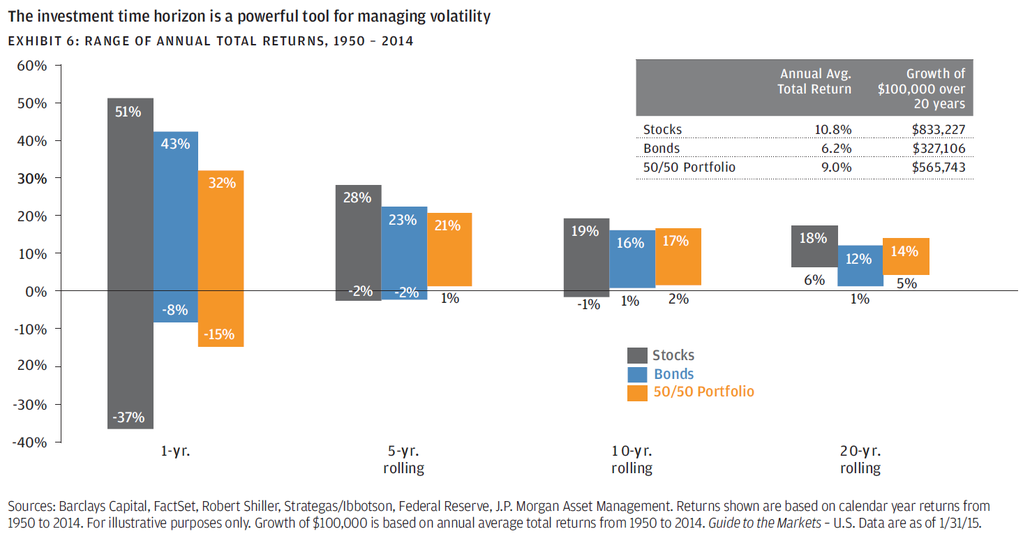

Since 1950 stocks have averaged 10.8% annually and bonds have averaged 6.2% annually. This is not new to most of us. We know that over the long term stocks outperform bonds. So why do we use bonds?

There are 2 primary reasons we use bonds. One is for yield, their interest. Bonds pay interest and that interest can be used to offset cash flow you may need or to enhance total return on your portfolio. The other reason and the one is that bonds are less volatile than stocks and often provide some well needed diversification in volatile times. Take a look at the chart below:

We believe in a diversified portfolio, not just to get returns from various places but also to manage risk….both volatility risk and depletion risk.