How many decisions in life have we all made that, upon reflection, you wonder: “what in the world was I thinking?”

Maybe it was a haircut you thought you could pull off or maybe you blurted out an errant comment that you later wish you didn’t… or maybe it was a purchase that you’d come regret? Life comes down to the decisions we make (or don’t make), and, unfortunately for us, because we are all human, that means we make some poor decisions.

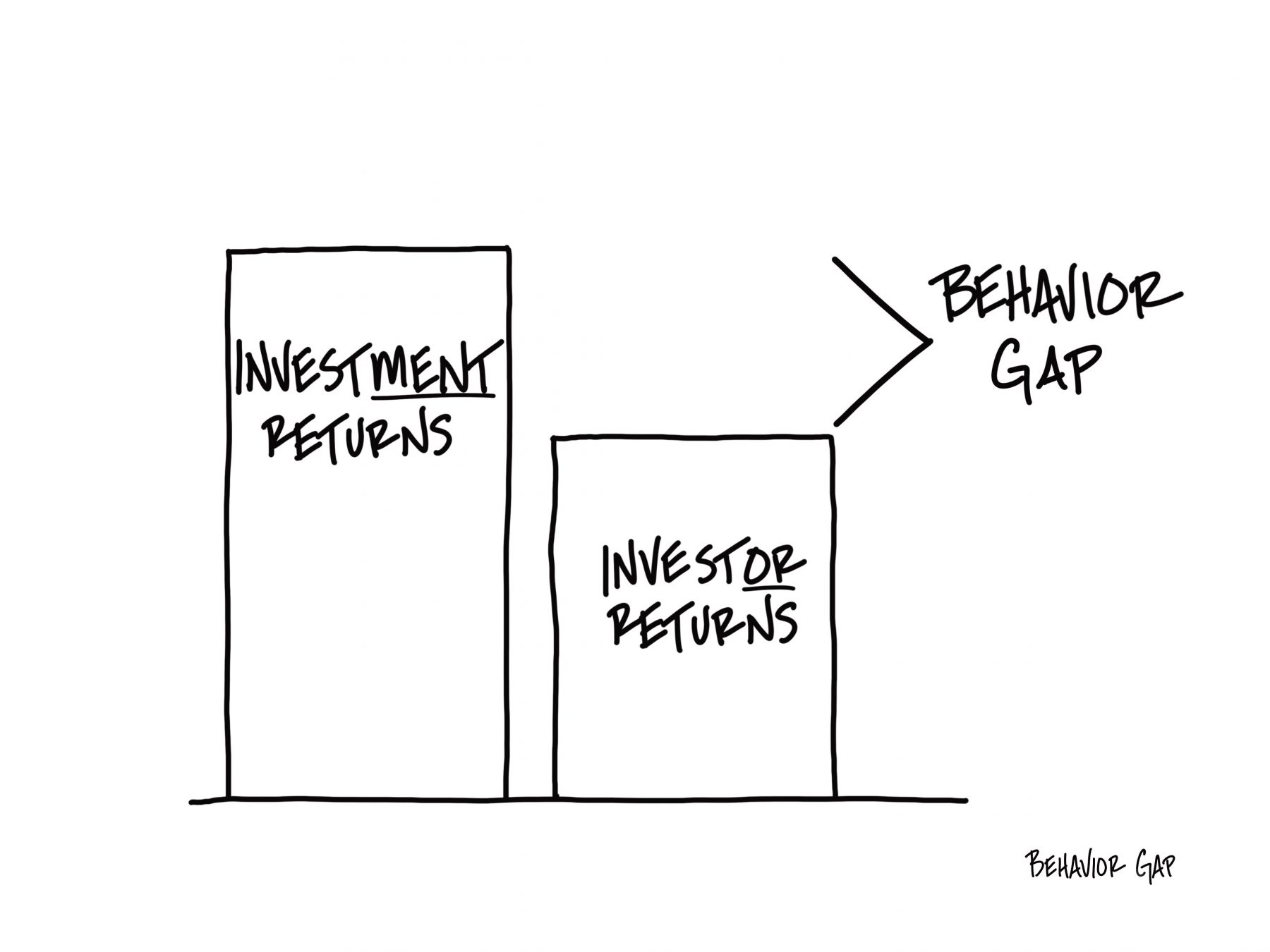

When it comes to money, there is a subfield of finance that specifically studies the psychological factors on financial decision-making called behavioral finance. Behavioral finance explores the intersection of human behavior and both cognitive and emotional biases that affect how we process and make investment decisions. One of the key components of this area of study in behavioral finance is the difference between investment returns and investor returns.

Investment returns are a measure of the actual financial gains or losses of an investment over a specific period of time, while investor returns take into account the timing and size of an investor’s contributions and withdrawals, buys and sells, to calculate their return, i.e., what the investor actually received. Although they both sound similar, there is, in fact, a massive difference.

Take this example:

Say you’re evaluating and performing due diligence on various investment options, and you come across a fund that has returned 7% a year for the last 10-years. The math on that is pretty simple: 7% a year for 10-years. That is the investment return.

If you were an investor and you put your money into that specific fund at the beginning of that 10-year period and you left it in there – meaning you did not touch it, add to it, or take from it – for 10-years, your return would be as advertised. But how many people actually invest this way?

Not many. Very few people buy long-term investments and hold them for the long term. Typically, most investors hold an investment for a few years and then become enamored with a new strategy or available option and change course all together. Our behavior is the driving force behind the difference in investor and investment returns.

Morningstar, a financial services research firm, conducted a study on the 3-year return of a pharmaceutical fund back in April of 2022. The investment returned 23%, however, the average return of investors was 6% lower.

Additionally, they performed another study spanning 10-years to understand how many months of performance contributed to a fund’s overall outperformance over the benchmark. They found that only 6-months contributed to a fund’s entire out performance. Meaning, if as an investor, you missed those 6-months, your return would be drastically different from the actual investments return.

Carl Richards, a CFP and New York Time’s columnist, dubs this as the ‘behavior gap’.

Let’s talk about your primary residence. Most people would consider this to be their best investment! But what we want to highlight is the behavioral component of this investment.

No-one buys a home just to live in it for 3-months, 6-months, 1-year, etc. No, people buy a home to live in it for the long term because it is a long-term investment. In fact, according to Redfin, the median homeowner tenure is 13.2-years. So, what’s the point we are trying to make?

We believe there is a strong correlation between how people view investments in their portfolio vs. their home and the actual returns of each. – Contrary to popular belief, the value of your home fluctuates just as much as the underlying securities in your portfolio. Imagine if you tracked your home’s value on Zillow daily? You’d drive yourself crazy! Would it then make sense to sell your home after 6-months and move a few streets over because the homes in that neighborhood had a higher ‘return’ in valuation? Of course not, because your home is your long-term investment, and you know by sticking with it there’s a great chance that after 10+ years your return on investment will be huge!

So, why do investors view their homes and portfolios differently?

It is easy to lose faith or become distracted when reviewing your portfolio. Stocks are much simpler to move in-and-out of as compared to a home, which makes these mistakes much easier to make. Here are a few facts, common mistakes that we see often, and our solutions.

It’s important to understand your bias and emotions, and how they influence your financial decision making. By better understanding these psychological factors you can avoid making irrational decisions that could impact your future financial position.