Where does the Market Currently Stand?

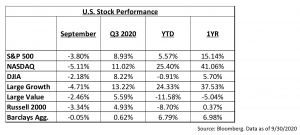

Global markets rallied in Q3, as both domestic and international stocks posted very healthy returns during the quarter. This past quarter was a tail of two environments, as both July (+5.6%) and August (+7.2%) skyrocketed higher, with the latter only seeing four daily declines during the month, driven by the largest technology names. Then, September happened and investors saw the market briefly fall into correction territory. Given the noise due to a lack of an agreement on a fiscal package and volatility surrounding the election, the month definitely felt worse than what the actual performance shows, as the market dropped a mere 3.8%.

So, what changed in September? From our analysis/perspective, the drop in stocks over the past month wasn’t so much because the fundamentals turned so negative, but instead because there was further mild deterioration on the margin on a few different key fronts. We believe this near month-long pullback remains more of a function of the market’s unrealistic expectations coming down more so than anything materially negative occurring.

More specifically, there were reasons for the drop in stocks in September:

First, and foremost, COVID-19 numbers surged in Europe and are again on the rise in the U.S. Now, to be clear, many investors aren’t expecting similar March-style lock-downs (especially in the U.S.), but at current index values, the S&P 500 is not pricing in a “third wave” of COVID. While we can’t declare this uptick another wave yet, the increased possibility (and subsequent headwind on the global economy) did weigh on stocks, as the market continues to hate uncertainty.

Second, the situation around fiscal stimulus became more complicated with the death of Justice Ruth Bader Ginsburg. Initially, we believe the market was assuming that a stimulus deal would occur by the unemployment benefits dead-line in late July. Then, after that passed, we believed that the market assumed a deal by the end of September (when the government needed to be funded again). Then, last week Congress agreed on a continuing resolution to fund the government through mid-December, leaving no resolution on the stimulus bill.

At this point, the most optimistic timeframe for a new, large stimulus deal is mid-November, but from our analysis that date assumes a lot of positives, including: 1) The Supreme Court nomination and approval occurs before the election (which is not a guarantee) and 2) That the election is settled within a few days of November 3rd. It’s the latter point the market became a bit nervous about at the end of the month, as both the Trump and Biden campaigns are amassing armies of lawyers ready to contest the election results if it’s close on November 3. If that’s the case, and that consumes Washington for several weeks, then it’s entirely likely that we don’t get a stimulus bill until early 2021, which is something many investors didn’t think was possible back in July.

Finally, economic data is starting to consistently show a “plateau” in the economic recovery absent any new stimulus, and while the economic rebound off the April/May lows remains impressive by our standards, it’s important to realize that the U.S. economy remains nowhere close to a pre-COVID normal. And if the economic data stays plateaued until we get stimulus (which again might not be until early 2021) then we view the idea that the economy is back to normal by early 2021 as a dream. Right now, we believe that the market continues to price in a “v-shaped” recovery in earnings. And if this doesn’t come to fruition, investors may see some turbulence.

While none of these events are bearish gamechangers, we believe September continued the process that began at the beginning of the month deflating the unrealistically bullish expectations that led the S&P 500 to 3,500, i.e., a market that was priced to perfection. Point being, unless we get more deterioration in the economic data, a surge in coronavirus that results in lockdowns here in the U.S. (we believe unlikely) or vaccine disappointment, it appears that most of this pullback is hopefully behind us. Though, from a market standpoint, we think there’s enough unknowns over the next six weeks (the election and economic data) to continue to realize that there is a high probability of investors encountering heightened volatility.

Bottom line, stocks continued to pullback in September and we believe rightly so as the reality has not matched the “perfect” scenario priced into the markets at the start of September. And, we’d expect more volatility into the election.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase of sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment and tax professional before implementing any investment strategy.

The S&P 500 Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, covering approximately 80% of available market capitalization.

The Russell US Indexes, from mega cap to microcap, serve as leading benchmarks for institutional investors. The modular index construction allows investors to track current and historical market performance by specific market segment (large/mid/small/micro cap) or investment style (growth/value/defensive/dynamic). All sub-indexes roll up to the Russell 3000® Index. The Russell US Indexes can be used as performance benchmarks, or as the basis for index-linked products including index tracking funds, derivatives, and Exchange Traded Funds (ETFs).

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. This includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities and collateralized mortgage-backed securities.

Securities offered through Triad Advisors, LLC. Member FINRA/SIPC. Clearing, custody or other brokerage services may be provided by Fidelity Brokerage Services LLC or National Financial Services LLC. Member NYSE, SIPC. Investment advisory services & insurance services offered through Sugarloaf Wealth Management LLC, a Registered Investment Advisor not affiliated with Triad Advisors LLC or Fidelity Investments, Inc. Please do not place orders for investment transactions on the email system, they cannot be honored.

Any tax advice contained in the body of this material was not intended or written to be used, and cannot be used, by the recipient for the purpose of (i) avoiding penalties that may be imposed under the Internal Revenue Code or applicable state or local tax law provisions, or (ii) promoting, marketing or recommending to another party any transaction or matter addressed herein.