Market Timing

‘Loss-aversion’ is a phenomenon where a real or potential loss is perceived by individuals as psychologically or emotionally more severe than an equivalent gain. Think about that for a moment… Losses ‘hurt’ more than a gain of equivalent value feels good. We are naturally designed and wired to avoid the ‘pain’ that is caused by losses.

In times of great volatility, we understand that these feelings can bubble up to the surface and cause you to act irrationally and potentially make poor investment decisions. We believe the most common mistake that investors make is attempting to time the market. Here’s why we believe this can be a detrimental mistake to your financial plan.

Investing involves risk. If you’ve been around us at Sugarloaf, we spend a lot of time and energy educating our clients on the relationship between risk and reward. The greater the potential risk, the greater the potential gain or loss, and vice versa. It is unavoidable. During bad market cycles losses are obviously amplified. Again, this is all part of the natural cycle of investing. But it is during these times that the power of losses can cause investors to lose sight of their long-term goals/plans and change strategies all together.

The most common strategy mistake is when investors attempt to time the market by selling out of their strategy to avoid the short-lived downturn and invest back into the market at the bottom. Sounds simple and lucrative, right? Unfortunately, this is nearly impossible and usually has the opposite effect on your portfolio. Here’s why:

When attempting to time the market, you must be right twice:

1. Selling at the top of the market (to avoid any losses).

2. Buying at the very bottom (to receive the maximum gain).

Nobody can predict the future and truly know if the market has peaked or reached its trough (bottom). Even the most skilled investors at best just have an educated guess and are often wrong.

So, what ends up happening?

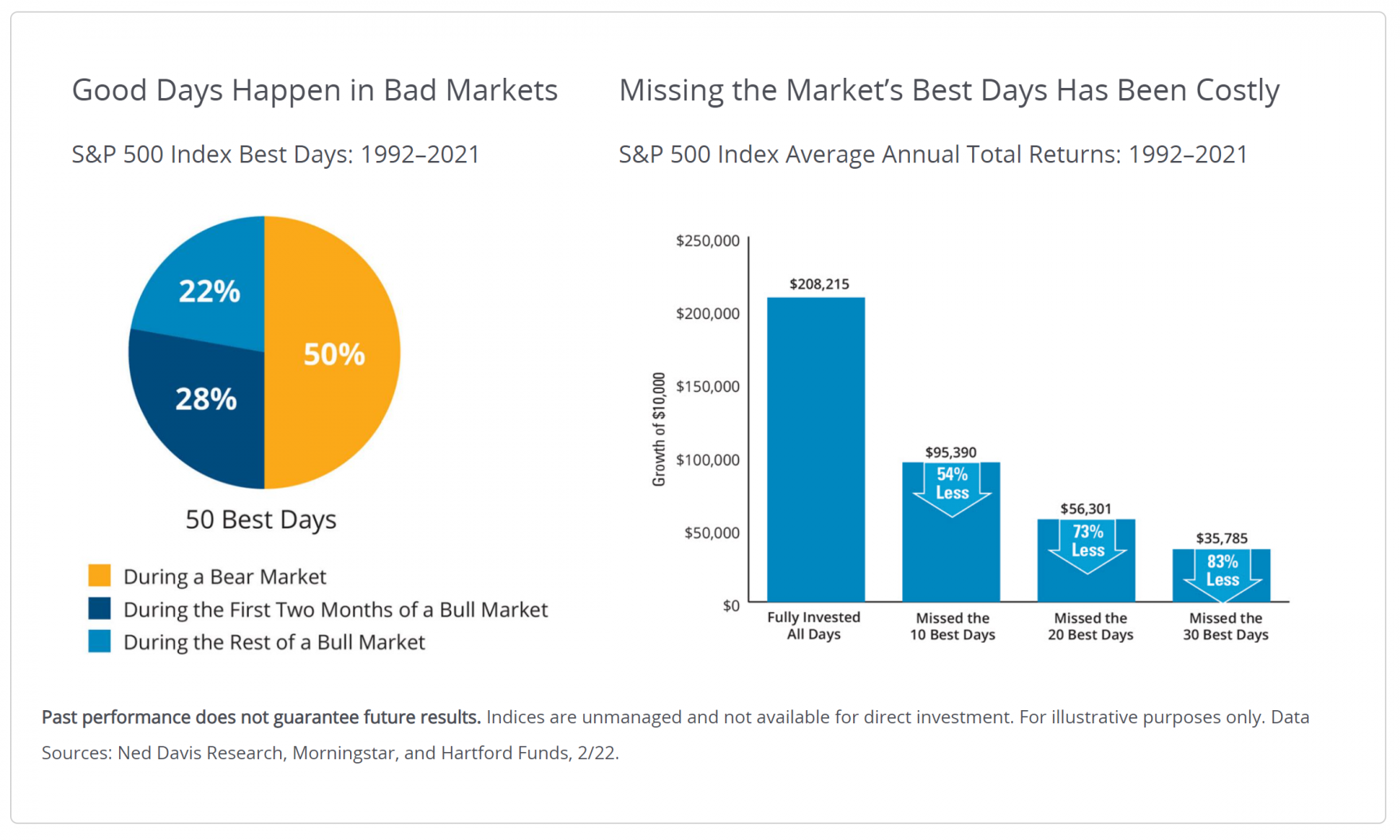

Because it isn’t possible to consistently time the market, investors end up missing out on positive returns. “78% of the stock market’s best days occur during a bear market or during the first two months of a bull market. If you missed the market’s 10 best days over the past 30 years, your returns would have been cut in half. And missing the best 30 days would have reduced your returns by an astonishing 83%.” (Source: Hartford Funds).

These statistics are not good and that is why we put so much emphasis on planning. Creating a detailed, comprehensive plan is critical to your success. Why? Because we know that if times were always ‘good’ then there would never be anything to worry about… but that’s very rarely the case. We live in a complicated world and know that very seldomly does everything go exactly according to plan. These uncertain times are what we plan for. A plan will keep you on track and prevent you from making a costly mistake that jeopardizes your chances of achieving your goals and the future you want.

There is a psychological piece to investing that has nothing to do with ratios, technical analysis, macro-economics, or anything else. We must learn to understand and master this element of our being if we have any hope of ever being ‘successful’ investors. We are confident that no-one makes these poor decisions with negative intentions. Afterall, like we said above, it is just how we are all wired. But unfortunately, we always envision these decisions going in our favor and fail to acknowledge the other side of this reality.

In one of our office locations, we have this reminder from Carl Richards hanging on our wall. Simple, but profound… and unfortunately the most common outcome for market timers and those who don’t stick to their plan.

Don’t let the current market cycle discourage you. Stick to your plan and trust the process. We are confident the best is yet to come!