Recession by definition isn’t that scary, it’s simply a decline in Gross Domestic Product for two consecutive quarters. This alone shouldn’t keep you up at night. However, what can be very scary are the mistakes made while attempting to avoiding these downturns and how each choice can significantly impair your financial plan.

From our previous blog, The Great Plains – It’s Flat Out There, we have pointed out the Fed’s number one goal – to stop inflation. From their commentary, it would appear they are comfortable with the current state of the stock market and are fully focused on their goal of squashing high inflation. But can they do this without causing a major economic slowdown? We equate this to hang gliding through a forest of giant sequoia’s while attempting to safely land in the pasture of green grass on the edge of a cliff overlooking the Pacific Ocean… Too little and you end up in the trees and too much you end in the Pacific Ocean of a ‘Fed policy mistake’. We hope they can make the right call!

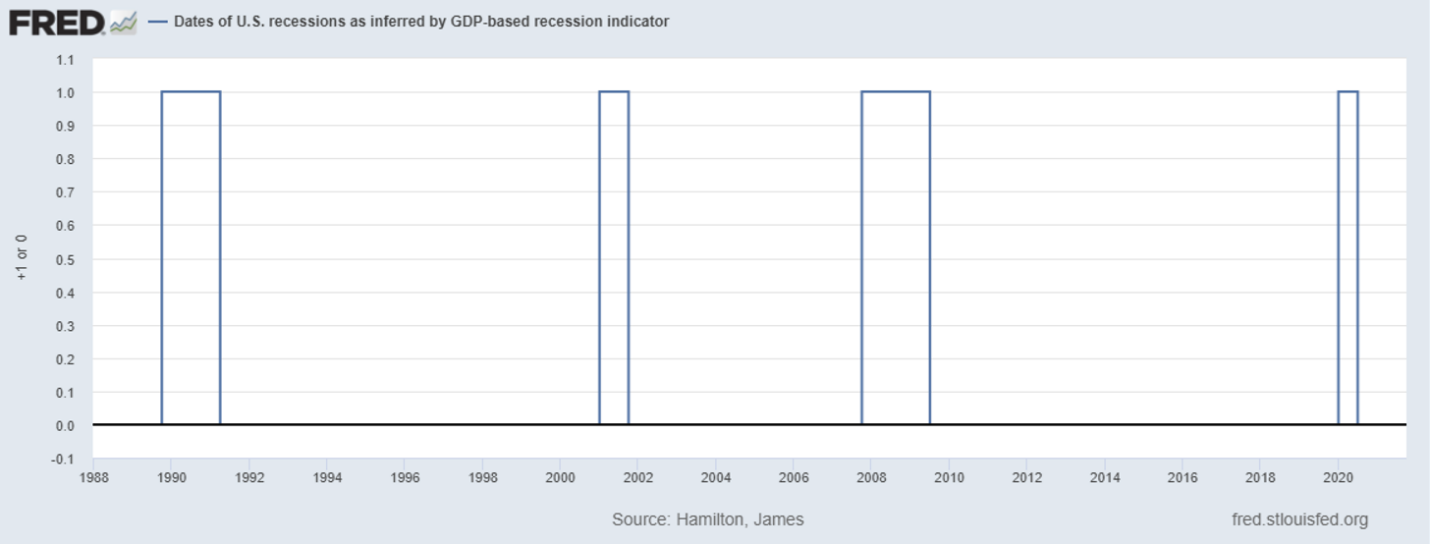

If this next quarter brings us another decline in GDP, then the US will be in a recession. Can we still avoid one? Absolutely – but the odds are slipping. We want to use this time as an opportunity to sure up your financial plan and help you be prepared for the storm (even if one does not come). Below is a list of helpful steps you can take now to build up your ‘Recession Toolbox’. We believe these will help you fine tune your plan for whenever we do encounter our next inevitable recession.

1. Keep personal debt within check or totally eliminate it.

2. Evaluate your future income potential. If sales drop in your organization (or if costs rise) will your personal income be affected?

3. Divide items into non-discretionary and discretionary. If cash-flow becomes tight, you will know exactly where to pull from.

4. Assess the equity in your home and avoid tapping it for discretionary spending.

5. Build up your emergency fund.

6. From an investment perspective, cash can help you be opportunistic in the event of a price reset in housing, commercial property, stocks, and more.

7. Check your disability insurance levels.

8. Try to avoid big ticket items such as vehicles unless it’s absolutely necessary. You might have a better opportunity to purchase at a cheaper price later.

9. Check the risk on your portfolio.

10. Keep investing according to your plan and not your emotions – your plan is created for both good AND bad economic cycles!

11. Speak with someone about it – it’s much easier to navigate rough waters with a counselor or advisor on your side.