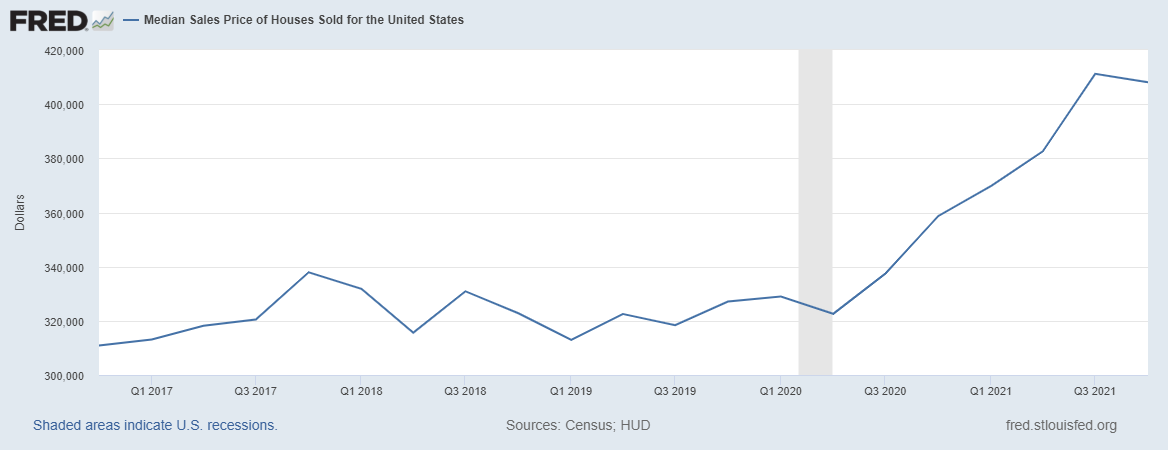

Homeowners are facing interest rates above 4% for the first time since Q2 2019. Historically speaking, we understand 30 year fixed mortgage rates remain at low levels, but the recent surge is increasing quicker than you may realize. With rates now following suit of an already white-hot housing market, many new, prospective buyers are quickly getting priced out if they are borrowers. Q2 2019 – the median home price equaled $322,500. Fast forward to Q4 2021 – the US median home sale price equaled $408,100 according to St. Louis Fed data – a 26% increase!

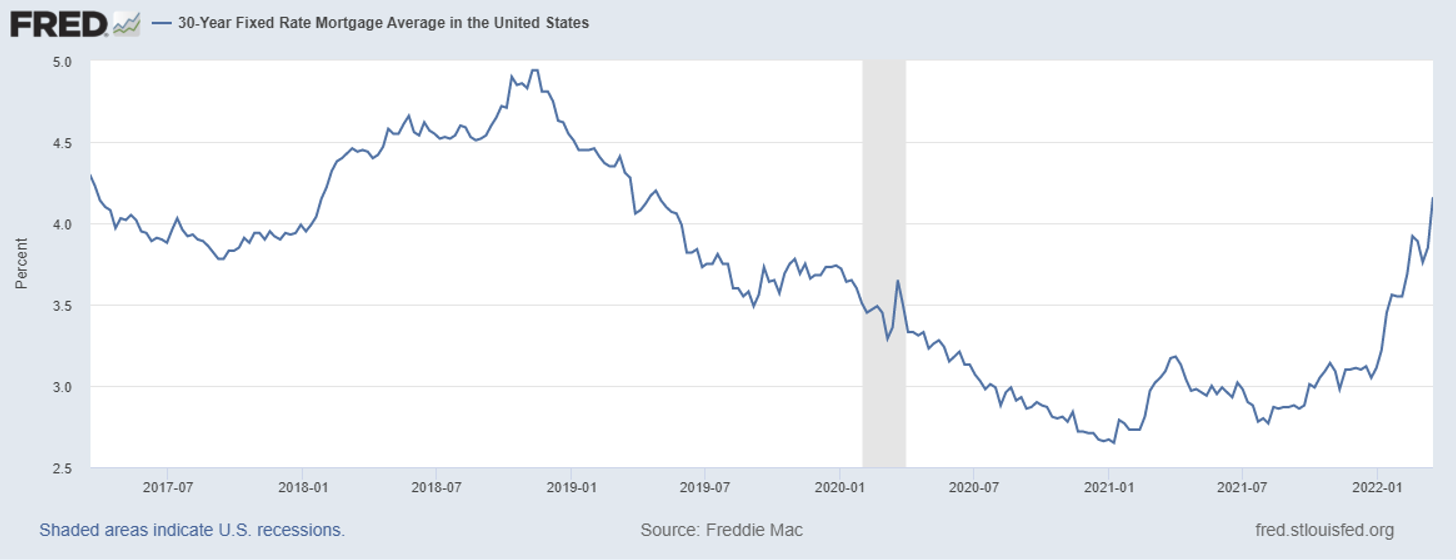

Low interest rates coupled with high demand and low levels of building has contributed to a shift in equilibrium home prices. First let’s look at interest rates more closely. During the initial stages of the COVID pandemic – the Fed set up extraordinary measures including the purchasing of Mortgage Backed Securities to help reduce U.S. consumer borrowing costs. In the gray bar below – you can see the recession from the COVID lockdowns, and then the steady move down to the January 2021 low of ~2.65% for a conventional 30 year fixed mortgage. Fast forward to today and the rate of increase back above 4% has been extraordinary.

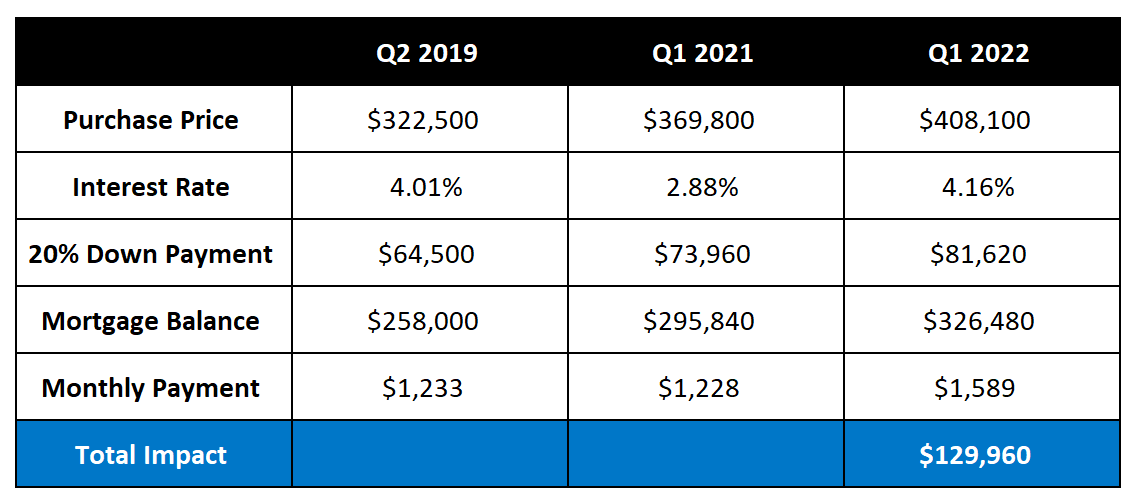

So, how does this rise in both interest rates and home prices effect mortgage borrowers? Let’s review a side by side comparison. What happens if price stays close to Q1 2022 levels at today’s interest rates?

Not only is more required for a down payment when prices rise, but the monthly mortgage payment increased 29% from a year ago! In our opinion, this impacts first-time home buyers the most. Existing homeowners can “bring their equity” with them from a previous home sale to help counter the impact of the rising borrowing costs. A first-time home buyer does not have this luxury and has both higher prices and higher interest rates working against them.

Solutions? There are a few:

Wait and Save – Wait longer to buy your home and save more for a larger down payment to help reduce the monthly mortgage payment. The risk involved with this option is that prices may continue to rise. In this scenario, deciding if you have the capacity to save at a rate that outpaces the current housing price increases becomes important. Couple this with rising rents, you quickly realize how difficult this can be to get ahead. The advantage to delaying and saving is prices may eventually level off or even decline. If rates fall in the future, then affordability dramatically increases! But it’s hard to imagine this scenario in the short term, without having a recession.

Buy a Smaller Home – This, a more obvious solution, will require a smaller down payment and also allow for a smaller mortgage payment. If you are a growing family, you’ll want to weigh the risks of buying a smaller home with the potential need to increase square footage down the road. The Great Financial Crises taught us that home prices aren’t immune from large drops. This could make the affordability of a larger home more attainable, but would a significant drop in home values would also hurt on the sell side of your existing home and, therefore, require additional savings to float the purchase.

Buy a ‘Fixer Upper’ – With low housing inventory and lack of consumer choice in today’s market, buying an older home can provide enormous long-term value, especially if property upgrades are made. For a first-time buyer, improvements can be made over time, limiting the amount of initial cash spent in the earlier days of home ownership. This is most practical for families who desire is to stay in their home long-term. With home improvements over time, your investment has a higher likelihood of paying off down the road.

Build a Home – Again, with inventories at relative, historic lows, new home building can be a viable option depending on the pricing of building materials. This option makes the most sense for those with the time to wait for both material pricing to moderate and the capital to buy land (often requiring a higher initial capital outlay). The borrower must also navigate the construction loan process. Building a home with today’s material prices is probably best reserved for those who plan to stay in the home for many years.