As we reflect on the past few years, it is always important to keep perspective. Despite the seemingly endless pessimistic headlines, we entered 2022 coming-off a 3-year bull run. Along the way we experienced many highs and lows, and everything in between. In our endless pursuit of excellence and constant reinvention, we learned many things, not only about ourselves, but our clients, too.

Here at Sugarloaf, we use every season, good or bad, as an opportunity to grow and learn. Below we have consolidated a brief list of things we’ve learned and observed from our clients over the past few years.

1. Your Risk Tolerance Will Change – It is impossible to truly gauge your risk tolerance in the middle of a bull market. When times are good, your tolerance for risk will likely increase, too. That’s human nature. The ‘fear of missing out’ is a strong catalyst for pushing you out of your comfort zone. And then, on the opposite end of the spectrum, when we encounter volatile times, your risk tolerance likely reverts and you become much more risk averse. It is important that we understand the relationship between these two feelings and determine a comfortable middle ground. Having a strong grasp on this tendency will help avoid costly mistakes.

2. Emotions Are Real – If no one has ever told you, let us be the first: emotional investing is bad investing. With that said, we understand emotions are real. They are a driving force to how we all make decisions on a daily basis. To ‘win’ with money, we have to remove emotions from how we invest. It is counterintuitive to think it is a great time to be investing during a government shut-down or on the brink of a world war… or that it is a good time to sell an investment after a good, long run. Emotions will tell you that neither scenario is logical. But, history, statistics, and knowledge tell us otherwise. Warren Buffett says that “if you cannot control your emotions, you cannot control your money.” Rational thinking will always prevail. We understand as humans it is impossible to be completely emotionless… however, having awareness and control will always lead to better decisions. The higher the emotion, the lower the wisdom.

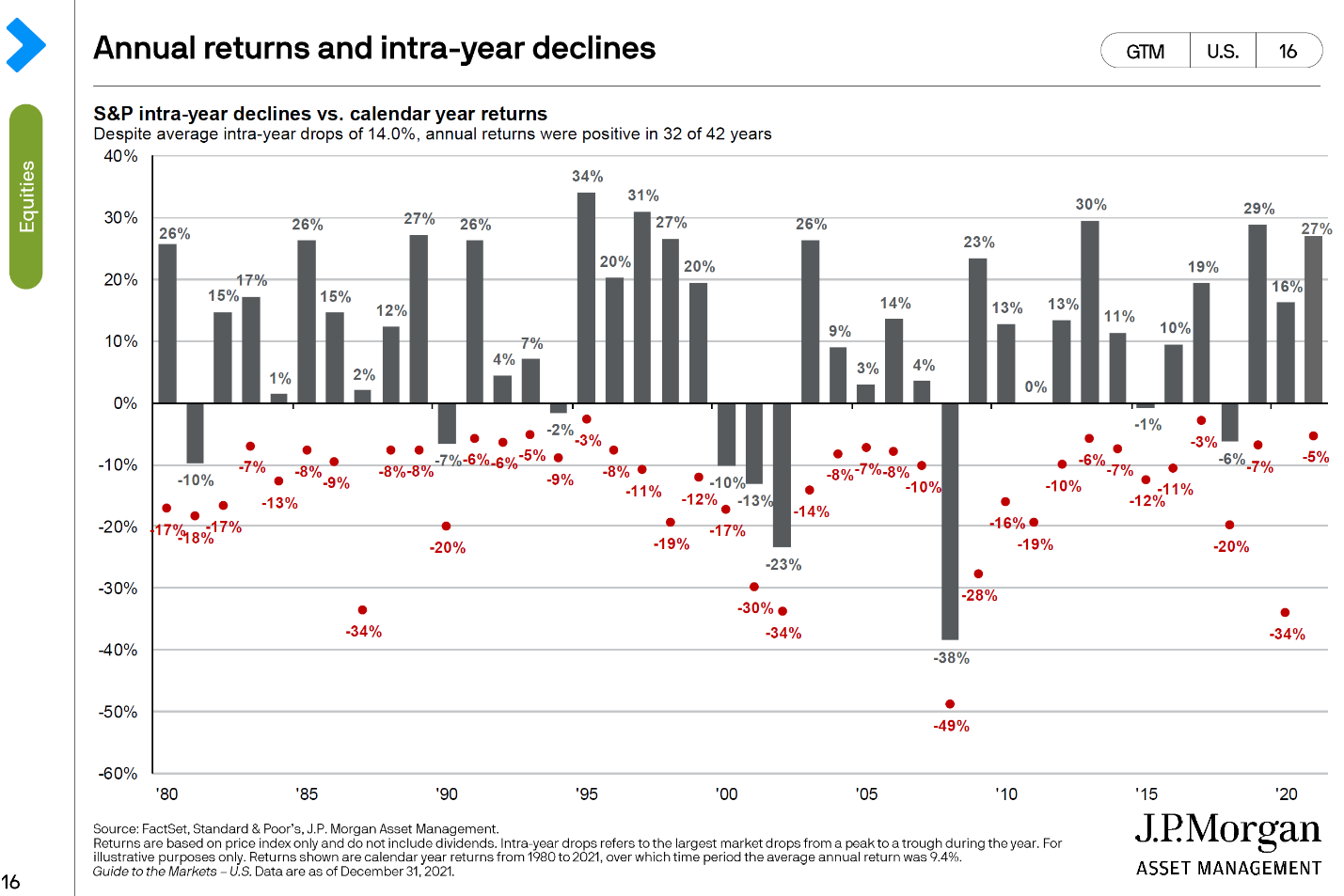

3. Risk is Always Present – When the going is easy, it is hard to see/feel the risk. But, don’t think for one second that this risk is not ever present. Risk is always there and will always be there. Unfortunately, you likely don’t see or feel it until it rears its ugly head. Inflation, war, terrorism, elections… all these events and catalysts are all the same as far as the market is concerned. Take a look at this chart below. Every red market represents an intra-year decline over the last 40-years and the black bar-chart represents the end of year return. Every year there since 1980, there has been a different catalyst (risk) causing volatility. Look at the probability of having a positive outcome! –The market will go up and it will go down and then up again. Risk is ever present and will always be apart of the conversation as it relates to your investments.

4. Time is Your Most Valuable Variable – Over time, the probability that the market ‘wins’ or is positive, is overwhelmingly in your favor. We know this and statistics proves this. You don’t need every penny in your portfolio all at once. That is why it is so incredibly important to have a purpose for every dollar and create an investment plan that is based upon the time you do have. Segmenting your money and the risk you’re taking by time horizon will help provide you with the clarity and comfort needed to have full faith in your plan. (I.e. Money that I need in the next 1-3 years, we will invest conservatively; money for the next 3-5 years will be invested moderately, and so on…)

5. The Plan is Our “North Star” – The most valuable thing you can do is create a plan BEFORE investing a single penny. If not, your emotions will override the plan and dictate your course of action. Determining your plan and PRE-deciding your response to a both a bear (negative) and bull (positive) market is essential to your success. By committing to these decisions in advance, you are able to make wise, rational decisions to keep you on the right path when emotions run high.

6. Cash Rules Everything – Having cash on hand during a market downturn can be an unbelievable opportunity to buy quality investments at a ‘discount’. On the contrary, it can also be incredibly frustrating to have on the sideline when the market is raging higher. – (Not to mention the negative effect inflation can have on your purchasing power in this environment… but that’s a conversation for another time).

For retirees and those in the distribution phase, having an income ‘bucket’ is key. Having a cash/conservatively invested sleeve of your portfolio that satisfies at least 1 year worth of future withdrawals is essential to your success, regardless of market conditions.

We should never stop learning from our past and using it to fuel future growth. Statistics show that disciplined investors will outperform emotional investors. Which are you?