As we accumulate wealth and look to save for a variety of goals, there are quite a few factors that you will want to consider before making the decision of how to invest. Understanding how to balance risk and reward and how it relates to your specific goals is not easy. Add to that equation the different time periods we have lived through, each of which inherently change the view we have on money, and you quickly have a complex decision at hand.

As outlined in the Psychology of Money book by Morgan Housel in much more detail: “people from different generations, raised by different parents who earned different incomes and held different values, in different parts of the world, born into different economies, experiencing different job markets with different incentives and different degrees of luck, learn very different lessons.” Today, lets focus on how a sequence of returns can impact your plan and discuss balancing risk that fits not just your plan, but you.

Sequence risk looks at periodic returns and the variation of when those returns are received when taking income. If you take an investment over a 10-year sample period (with different returns each year) and then reverse the sequence of returns, your ending balance is the same. That is not the case if you are taking income. Pretty self-explanatory: as you take income, your bucket to compound capital is less, resulting with a portfolio needing even more growth to recoup losses. Although we believe longer term horizon returns are most meaningful to meet goals, the returns the few years before and into retirement become very important to a successful plan.

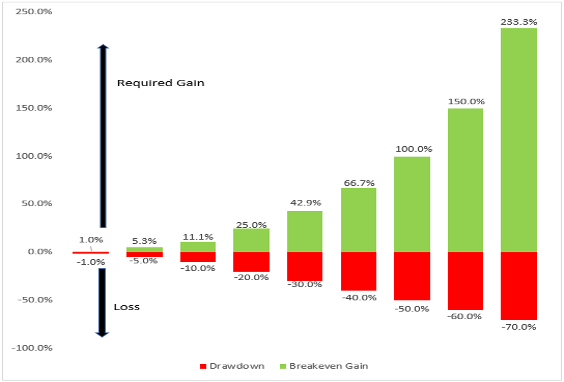

My hope with this discussion is that it may serve as a way to think through needed vs. desired returns. Risk and return are directly correlated, so you cannot talk about one without the other. Related to taking on risk that can lead to portfolio declines, the chart below shows the required gains to get the portfolio back to even after different levels of market drawdowns. Keep in mind that there are no income distributions in the below illustration. A portfolio drawdown of 30%, requires 42.9% to get back to the balance before the market decline.

Source: Aptus

“Compounding capital is the royal road to riches.” – Richard Russell in Rich Man, Poor Man

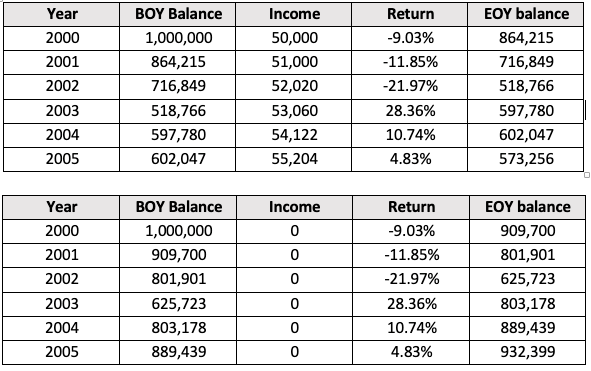

The two scenarios below illustrate a sequence of returns with and without income taken.

Through the period outlined above, the retiree took $315k in total income (5% of the initial account balance pulled at the beginning of year 1, that $50k number is then adjusted 2% each year for inflation) and has an ending balance of $573k vs. an ending balance with no income leaving your million dollars at $932k.

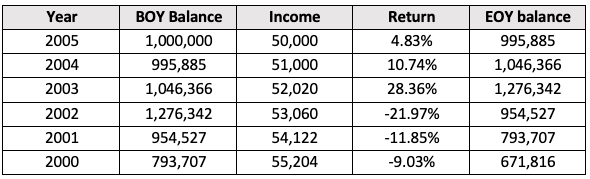

Let’s look at the same scenarios as above with the returns reversed. Again, the same returns, just rearranged. You end up with a balance nearly $100k more which is 17% higher. That is certainly a meaningful difference and hopefully illustrates the importance of managing risk in the early years of retirement.

There is no shortage of intelligent investors who evaluate markets and provide expected returns for us each year, but the truth is none of us have a crystal ball. Negative outcomes or performance below expectations happen to the best of us. In retirement, take sequence risk into consideration, how are you able to plan for negative markets? Does your distribution strategy have the flexibility needed? Have you revisited your risk as you approach or enter early retirement?

These are all questions we would ask in an effort to build a buffer of some kind to help you stay invested as much as you can to recoup any potential losses, sell the right securities when taking income, and making sure the portfolio, as it sits today, is well aligned with your plan and risk. Depending on your age and experiences you may be the most optimistic investor here. Optimism is great. Possibly that optimism leads to taking on more risk than necessary? Or, alternatively, maybe you are on the opposite side of the spectrum? The bottom line is that your personal experiences matter and so does your plan. Whether you are retired or a young professional focused on saving, the principal of compounding returns can never be discounted.

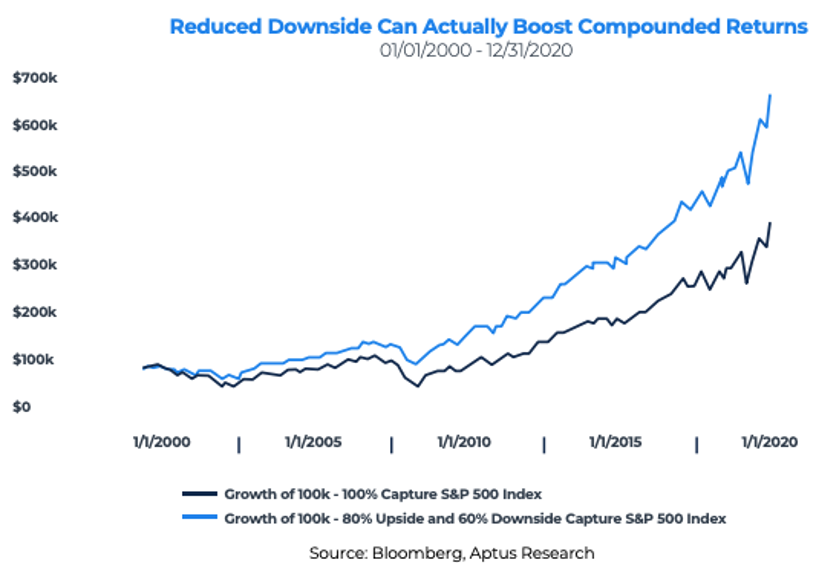

Let’s take a look at the power of consistent returns in the below example. The black line includes 100% upside/downside capture of the S&P index. The blue line provides 80% upside capture, and 60% downside.

Two key items to address…

The first being that your plan must account for negative outcomes to understand what your true risk appetite is. If you have done that and continue to do that year over year you should have more comfort staying invested. Taking income plus negative returns can be a double whammy to the success of your plan. Take an inside look at your history with money which has led you to where you are today… How are those experiences affecting your ability to manage risk within your plan? Adjustments to your strategy may still be needed over time as the market environment and your goals change. BUT, if you were to move to cash after a drawdown event and continue taking your income, the sequence of negative returns followed by zero returns would then further inject longevity risk into your plan.

In addition to managing portfolio risk, flexibility in your plan is also a must. Adapt to the market conditions, adjust costs where you can, be strategic with taxes, tweak your income plan, turn that hobby into a small business; this list could continue for a few pages. A perfect example of being flexible is adapting your investment plan to adjust to today’s market conditions. Whether you are concerned about elevated risk in equity markets, or you are looking to navigate higher inflation paired with historically low rates – each will play a role in your plan and investment strategy.

“The highest form of wealth is the ability to wake up every morning and say, I can do whatever I want today.” – Morgan Housel, The Psychology of Money

Retirement planning takes time, patience, and an understanding of projected outcomes. Projected being the key word here. We are predicting what we will have and making estimates of what may happen around us. Ultimately, we believe assessing the risk in all asset classes can help you build a more accurate and achievable plan. As we all attempt to achieve our own highest form of wealth, the impact of early negative performance years while taking income is something you should plan for in retirement.